How Freelancers Cope With Money Lack: Where to Get Money?

A slow late morning, a cup of coffee, and a wistful smile while turning on the laptop. Oh, and certainly, regular trips with friends and a permanent good mood. It is the picture of a freelancer’s life from an office workers’ point of view. Nothing can be further from the truth than such expectations.

What to know about a real freelance routine? It consists of constant late nights, scuttled deadlines, nervous breakdowns, overwork, and, very often, a lack of money. No one promises monthly paychecks if you leave a regular job; all the responsibility regarding finances is only on you.

But what to do when your wallet is empty? Here are some recommendations helping to overcome money lack.

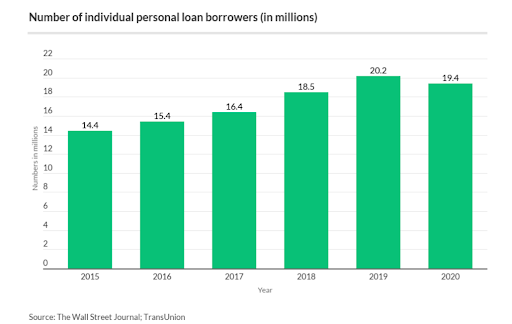

#1 Applying for a Loan

Actually, the first thing crossing my mind is to borrow money from the bank. Usually, employed people have no problems getting a personal loan of some kind. But things get worse when we are talking about freelancers.

They don’t work for any organization, and even if the previous credit score is high, their loan applications are almost always declined by banks. What to do in this situation?

Well, there is one option suitable for freelancers. We mean different apps for quick loans or online services. The review of the most popular apps and online lenders you can read on Fit My Money. Sometimes even a small sum can help to solve current problems, so if the situation is acute, try one of these apps.

#2 Creating a “Rainy-Day Fund”

Of course, these are prevention measures, and in a crisis, this advice is useless, but we want to mention it in this article because such funds can save you in hard times. In order to build such savings, follow two simple rules:

- Put away a part of your income. In the majority of recommendations, 10% is named as the optimal amount. You don’t notice the lack of this sum, but it will allow sparing enough money over time.

- Track all spending. Sometimes getting rid of useless waste is enough to save money for the future. So, don’t dismiss budgeting; it’s a valid tool for every freelancer.

#3 Get a Regular Job

Sometimes it’s better to step back and accumulate some resources than to continue and end up bankrupt. If you have no money for a long period, try to find a usual job and make another attempt later, when you solve current problems, pay all the bills and spare some money as a safety fund.

Don’t think of it as a failure; let’s call this step a strategic withdrawal. You can start another attempt at any suitable time, so getting a job is not the collapse of plans, and it’s definitely better than to receive an eviction notice from your landlord or miss several mortgage payments.

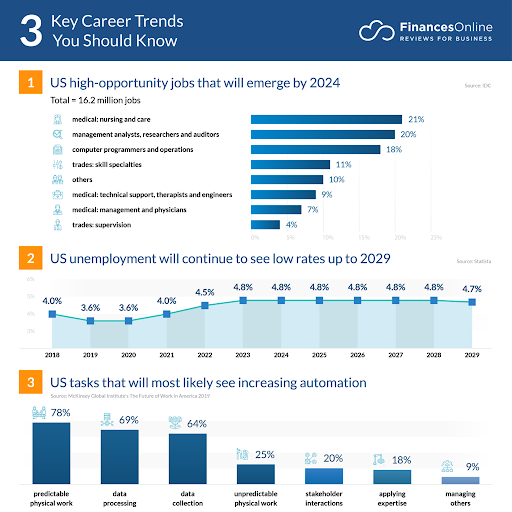

#4 Change the Field You Are Working In

The perfection of skills requires constant practice, and you can’t become a good specialist if you change your profession too often. But sometimes, it’s the only thing to do if your area of expertise isn’t an on-fire specialty.

It’s sad, but the freelance market develops in accordance with existing demand. So, if you notice that your profession is playing out, it’s better to change it.

You can look through the popular careers of the future, choose the most suitable for you, and start moving in this direction.

By the way, adopting a new specialty and mastering new skills reduces the risks of Alzheimer’s disease.

From this point of view, the new freelance profession will kill two birds with one stone: solve your money problems and improve your brain health.

#5 Accept New Technologies

This advice follows the previous one. Sometimes you need to train new skills, learn new techniques and devices in order to keep up with the developing market.

For example, if you are a tutor and only use Skype for classes, you substantially reduce the range of possible clients. Try new apps, resources, and apps for online tutoring and education; it will open new perspectives.

#6 Ask for Help

The previous pieces of advice are good if the situation isn’t that bad, and you have some money to ensure at least buying food. But what if the wallet is completely empty, and you have nothing to eat?

Don’t be afraid to ask for help. Maybe your pride prevents you from coming to relatives and friends, or you are worried they will refuse. Well, it’s time to get such thoughts out of the system. Pride is good only when the stomach is full.

Regarding the second point, we want to remind you of an old saying: if you try, you may lose, but if you don’t try, you’ll definitely lose. There is nothing shameful in asking for help. By the way, it can be not only the money you want to borrow but a job opportunity. You’ll never know if you don’t try.

#7 Sell Unnecessary Things

In better times, many people like to buy, and very often, they find out that the purchased thing is staying unused in the closet. In hard times, selling such items is the solution. It will free the space and bring some money, allowing you to get through this difficult phase.

Psychologists recommend getting rid of the possessions you don’t need from time to time; they say it will help your mind function more straight.

In the case of empty pockets, the unnecessary things become a valid source you can sell on different internet platforms. And remember that if you didn’t use something for a year, it’s highly unlikely that you’ll use it in the future, so don’t be sorry about getting rid of it.

Summing Up

Anyway, we hope that you read this article out of curiosity, not of desperation. We know how hard it is to earn money as a freelancer, and don’t underestimate the weight the lack of money can put on your shoulders. But remember that it’s just a phase.

If you continue trying and follow our recommendations, you’ll definitely get through it. Such a situation can also become an important lesson teaching the meaning of budgeting and planning in self-employment and freelance jobs.